- By Admin

- April 11, 2025

-

Financial Operations

Financial Operations

How to Manage AP, AR, Spend, and Expenses on One Platform

In todays fast-paced business world, managing finances effectively is a key factor in sustaining growth and operational efficiency. Companies, especially large-scale businesses, face the challenge of handling complex workflows, diverse vendor relations, and intricate procurement systems. Often, accounts payable (AP), accounts receivable (AR), spend management, and expense tracking are handled across multiple platforms, creating inefficiencies and increasing the potential for errors.

Regulatory compliance is a critical aspect of any financial system, especially in industries like manufacturing, retail, logistics, and government. This platform ensures you stay compliant with up-to-date regulatory requirements by automating tracking and auditing processes. With built-in compliance checks, your organization is safeguarded from potential legal issues, reducing the risk of financial penalties.

A comprehensive financial management solution allows businesses to streamline AP, AR, spend, and expense management, all in one place. These platforms offer deep integration with core finance solutions like accounts receivable (AR), accounts payable (AP), and vendor onboarding, eliminating the need for multiple disconnected systems. Lets explore how this solution can benefit your business.

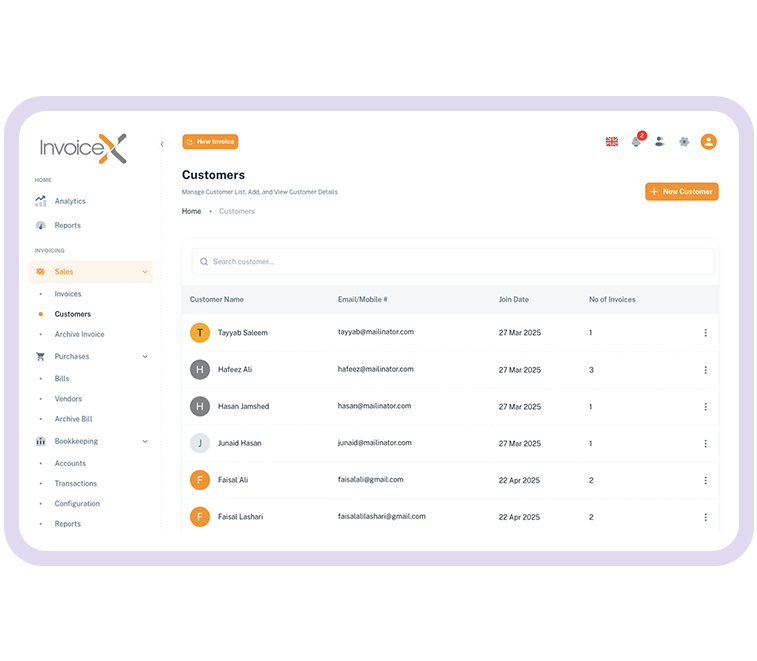

One of the standout features of this platform is its seamless integration with core finance functions. Whether its managing incoming invoices through AR, handling outgoing payments via AP, or simplifying vendor onboarding, everything is interconnected. This integration reduces data entry errors and saves valuable time, ensuring that your accounting team works with accurate, up-to-date information.

Large organizations often deal with a high volume of invoices and procurement processes. A customized platform is designed to handle these workflows with ease, ensuring smooth operations even during peak times. Whether youre handling a thousand invoices a month or complex procurement projects, the platforms scalability ensures that your business can grow without worrying about limitations in your financial infrastructure.

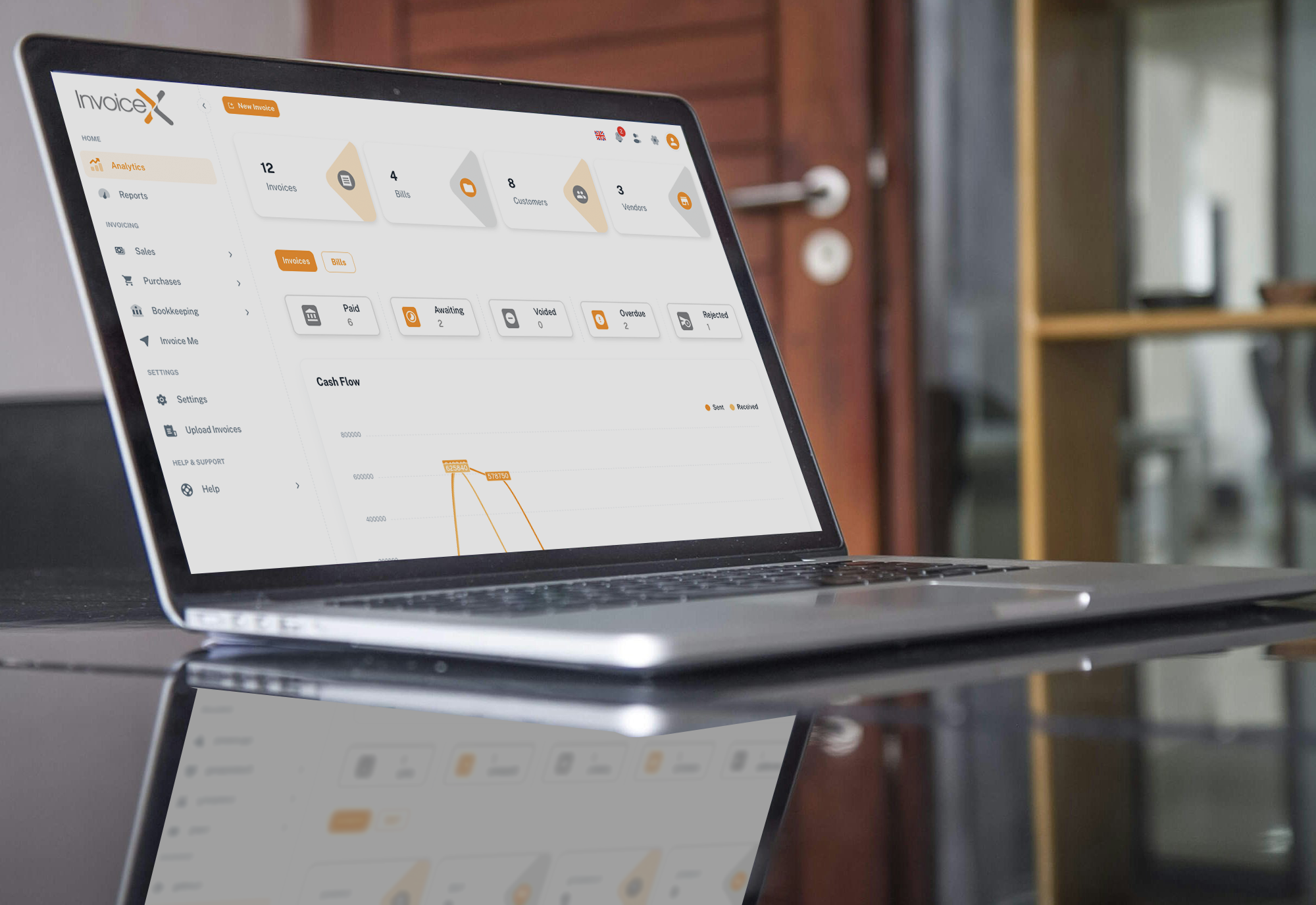

Data-driven decision-making is key to business success, and this solution offers powerful reporting and analytics tools that give businesses the insights they need to make informed decisions. From expense tracking to budget management, the platform provides actionable data that helps you monitor cash flow, identify trends, and predict future expensesall crucial for strategic planning.

Every business has unique financial processes, and a one-size-fits-all solution isnt always effective. The integrated platform is highly customizable, allowing you to tailor it to meet your organizations specific needs. Whether you need to adjust approval workflows, define custom expense categories, or create unique reporting formats, the platform adapts to your requirements.

Small and medium-sized enterprises (SMEs) face budget constraints, making it challenging to invest in expensive financial software. This platform offers a subscription-based model, providing SMEs with a cost-effective solution to manage their financial operations. Subscription plans allow businesses to scale their services as needed, ensuring that the platform grows with your business.

Managing invoices and tracking expenses can be cumbersome, especially with multiple tools in place. With integrated invoice management and expense management features, this platform provides a unified approach. From receipt capture to invoice approval workflows, businesses can quickly process, approve, and track payments, leading to more efficient financial operations.

Simplicity is key to adopting any new software, especially for smaller businesses that may not have dedicated finance teams. This platforms user-friendly interface ensures that even non-financial personnel can easily navigate the system. With clear dashboards, easy access to key features, and intuitive controls, businesses can adopt the system quickly, reducing training time and improving efficiency.

As your business expands, so do your financial needs. The platform offers scalable pricing plans that can grow with your business. From small teams to large-scale enterprises, you can choose a plan that matches your current requirements and upgrade as your needs evolve. This flexibility ensures that you only pay for what you need at any given time.

In todays increasingly remote work environment, cloud-based solutions are more important than ever. The platforms cloud-based access allows teams to manage financial operations from anywhere, ensuring seamless collaboration and real-time updates. Whether your team is in the office or working remotely, the platform keeps everyone on the same page, making it easier to manage financial workflows regardless of location.